The S&P/ASX 20 (XTL) is Australia’s narrowest stock market index.

The index contains the 20 largest ASX listed stocks and accounts for ~48% (September 2023) of Australia’s sharemarket capitalisation. All companies are highly liquid and considered “bluechip” shares.

The ASX top 20 companies offer little diversification with only 8 GICS Sectors represented. The Financials sector holds four of the five largest companies and accounts for ~36% (August 2023) of the index.

There’s currently one Exchange Traded Fund (ETF) that tracks the performance of the index: iShares S&P/ASX 20 (ILC).

IMPORTANT

IMPORTANTASX20list.com doesn’t provide share price data.

The best website is Market Index.

They have current ASX share prices, company charts and announcements, dividend data,

directors’ transactions and broker consensus.

How are ASX 20 companies selected?

Constituents are selected by a committee from Standard & Poor’s (S&P) and the Australian Securities Exchange (ASX).

All companies listed on the Australian Securities Exchange (ASX) are ranked by market capitalisation. Exchange traded funds (ETFs) and Listed Investment Companies (LICs) are ignored. The top 20 ASX stocks that meet minimum volume and investment benchmarks then become eligible for inclusion in the index.

Rebalances are conducted quarterly in March, June, September and December. If a significant event occurs (e.g. delisting, merger, etc.) an intra-quarter rebalance may be conducted. A minimum of two business days’ notice is given to the market.

Skip to the ASX 20: Sector Breakdown | PE & Yield | ETF

Skip to the ASX 20: Sector Breakdown | PE & Yield | ETF

ASX 20 List (28 April 2021)

Click here for the current Share Prices (and Stock Charts)

The 20 largest companies by market capitalisation (includes ETFs & LICs) and not S&P constituents.

| Code | Company |

|---|---|

| ALL | Aristocrat Leisure Ltd |

| ANZ | Australia and New Zealand Banking Group Ltd |

| APT | Afterpay Ltd |

| BHP | BHP Group Ltd |

| CBA | Commonwealth Bank of Australia |

| CSL | CSL Ltd |

| FMG | Fortescue Metals Group Ltd |

| GMG | Goodman Group |

| MQG | Macquarie Group Ltd |

| NAB | National Australia Bank Ltd |

| NCM | Newcrest Mining Ltd |

| REA | REA Group Ltd |

| RIO | RIO Tinto Ltd |

| TCL | Transurban Group |

| TLS | Telstra Corporation Ltd |

| WBC | Westpac Banking Corporation |

| WES | Wesfarmers Ltd |

| WOW | Woolworths Group Ltd |

| WPL | Woodside Petroleum Ltd |

| XRO | Xero Ltd |

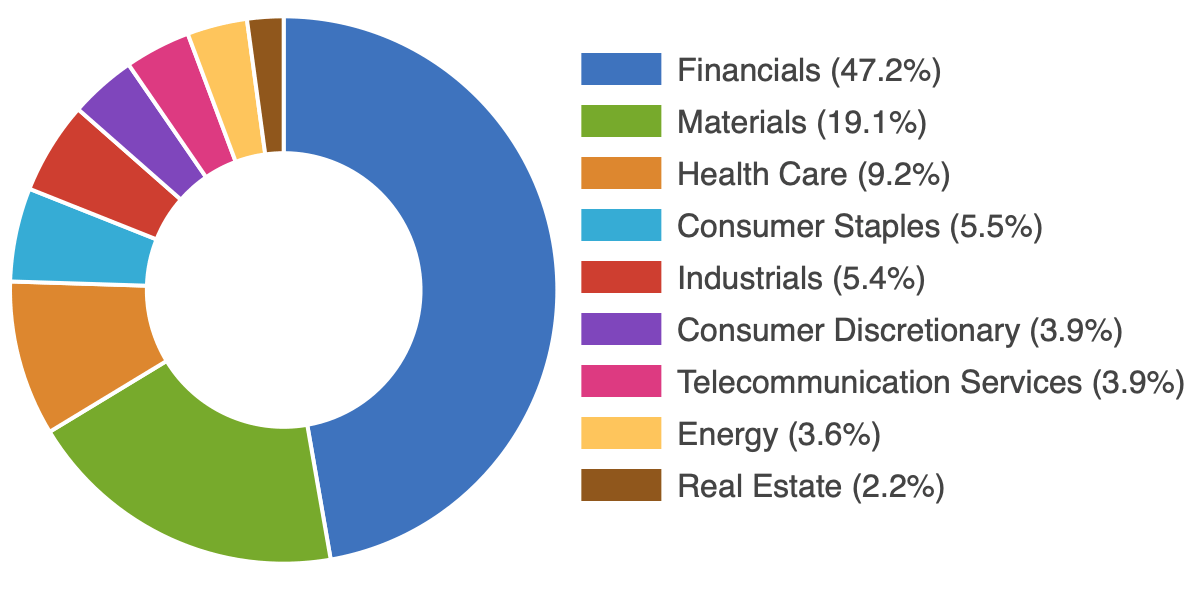

Sector breakdown

All S&P/ASX Indices use the Global Industry Classification Standard (GICS) to categorise constituents according to their principal business activity.

The S&P/ASX 20 Index only contains 9 of the 11 GICS Sectors. Information Technology, Consumer Discretionary and Utilities are not represented.

Data updated: 1 March 2019

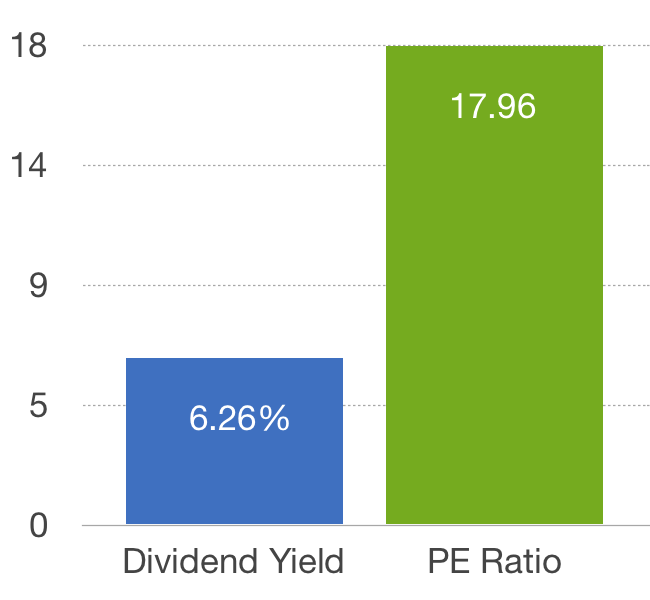

PE Ratio & Dividend Yield

Fundamental data for the S&P/ASX 20 Index is weight-adjusted by market capitalisation. Companies with zero or negative values are ignored.

Data updated: 1 July 2017

Exchange Traded Fund (ETF)

ETFs are managed funds that track a benchmark. They trade on the ASX like ordinary shares using their ticker code. The goal of an index fund is to replicate the performance of the underlying index, less fees and expenses.

As at 10 October 2016, the iShares S&P/ASX 20 (ILC) is the only ETF that tracks the performance of the S&P/ASX 20 Index.

| iShares S&P/ASX 20 (ILC) | |

|---|---|

| Manager: | BlackRock |

| Inception: | 6 December 2010 |

| Mgmt Fee: | 0.24% |

| Fact Sheet: | Link |